Imagine the heart-stopping moment when you spot an IRS audit notice in your mailbox. Just hearing “tax audit” can send a chill through any taxpayer. Audits mean a thorough look through your financial past, a process that can really shake things up in your life. In the twisty world of tax rules and requirements, going up against the IRS by yourself is like trying to find your way through a complicated puzzle with no clue.

Understanding Tax Audits and the Importance of Representation

Facing an audit can be intimidating, but having the right representation can make a significant difference. This article will explain what tax audits entail, explore the various types and what triggers them, and discuss how expert representation can help protect your interests, simplify the process, and potentially improve the outcome. Whether you’re an individual or a business, understanding these elements can provide crucial insights and preparedness when dealing with tax audits.

What is a tax audit?

A tax audit is a review conducted by the IRS or other tax authorities to ensure that information on tax returns is correct and complies with tax laws.

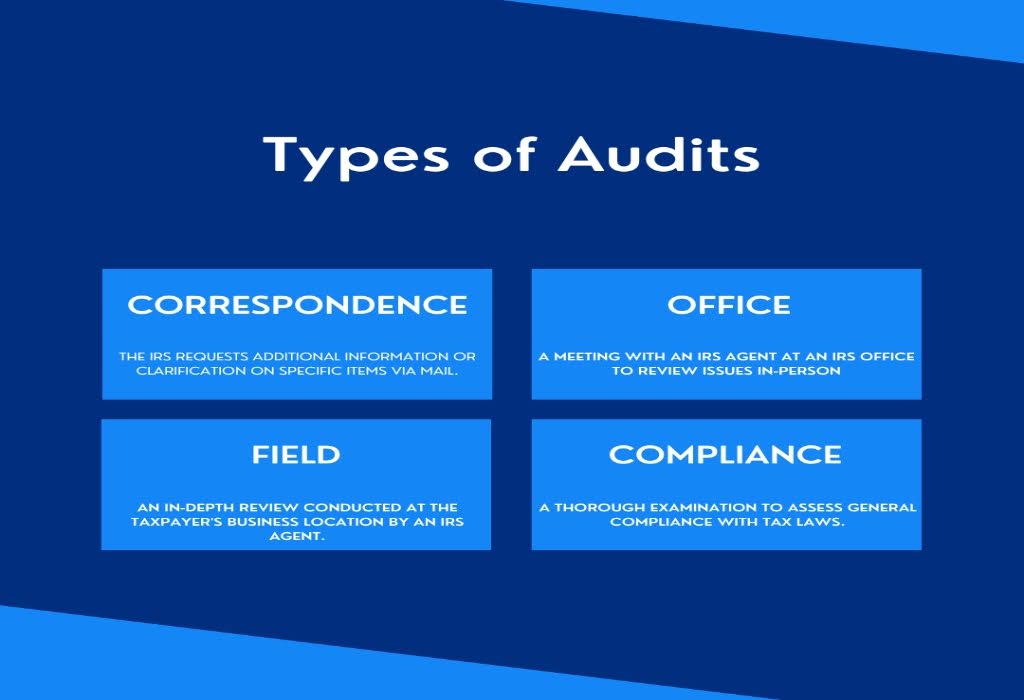

Different types of tax audits

The IRS initiates several kinds of audits based on the nature of the discrepancies and the complexity of the tax return in question. Here’s a breakdown of the main types:

The potential issues that may arise during a tax audit

During a tax audit, there are several potential issues that could surface. Inaccurate reporting of income, questionable deductions, or missing supporting documents can lead to the IRS questioning the validity of a tax return. In addition, the possibility of prior year returns being pulled into the current audit, especially where there’s a suspicion of fraudulent activity or significant under-reporting of income, can complicate matters. It is vital to approach these issues with seriousness and precision, making the assistance of an audit representative imperative.

The impact of a tax audit on your financial situation

The outcome of a tax audit can significantly impact an individual’s or business’s financial situation. If the IRS concludes there was an underpayment of taxes, this could result in owing additional taxes, interest, and potentially penalties. If you’re unsure how to handle an audit or feel overwhelmed by the process, contact J. David tax law or professional audit representation

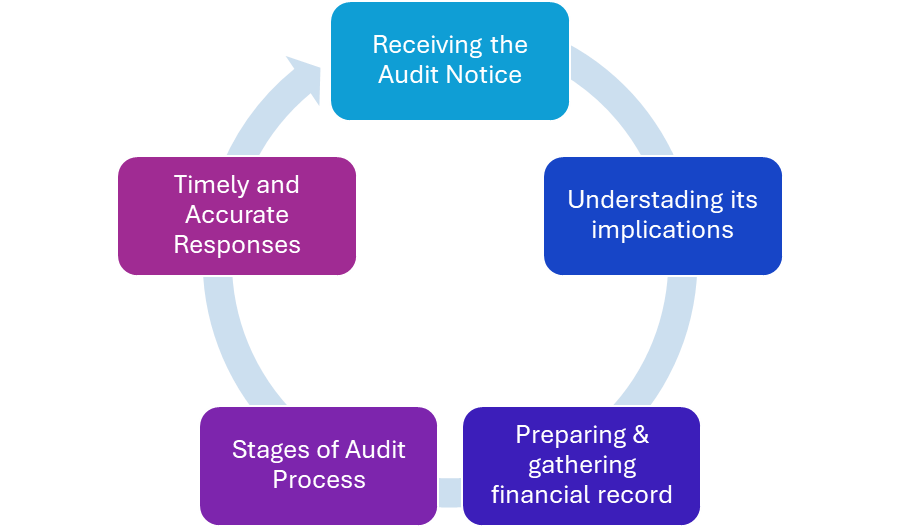

The Audit Process: A Comprehensive Overview

Receiving the audit notice

Upon receipt of an audit notice, it’s crucial not to ignore it—70% of audits are merely calls for additional tax return information. Speedy response to this notice is advisable, whether by providing requested information

Understanding its implications

This notice means that the IRS plans to review your tax returns to verify their accuracy and ensure compliance with tax laws. The review can uncover issues like underreported income or overstated deductions, potentially leading to the imposition of additional taxes, interest, and penalties. Recognizing the seriousness of an audit notice allows you to prepare adequately

Preparing for the audit and gathering necessary financial records

The IRS will typically request pivotal financial documentation such as bank statements, and receipts for business expenditures or deductions that substantiate tax entries. For instance, having detailed documentation of large medical expenses that justify deductions can be invaluable. It’s essential to respond to IRS requests for additional documentation within the established timelines, providing accurate details.

The different stages of the audit process

Stage | Actions |

Assessment | Review tax returns and strategize defense |

Communication | Engage in dialogue with IRS for resolutions |

Documentation | Provide necessary financial statements and proof |

The importance of timely and accurate responses to IRS correspondence

Responding quickly and accurately to IRS letters is key. If you’re slow to connect with your Audit Representative or don’t give them the necessary permission through a Power of Attorney, you could face higher charges and miss out on a strong defense. It’s vital to have all your financial records ready so your Audit Representative can build a solid case for you. By following the audit procedures and strategies they suggest, you greatly increase your chances of a positive result in your tax audit.

Types of Audit Representation Services

The professionals who are qualified to offer full representation services include Certified Public Accountants (CPAs), Tax attorneys, or Enrolled Agents (EAs). These individuals are licensed to practice before the IRS and can handle complex tax issues that may arise during an audit. Full representation becomes particularly essential when the taxpayer is unable to represent themselves due to reasons such as unavailability, unfamiliarity with tax laws, or incapacity.

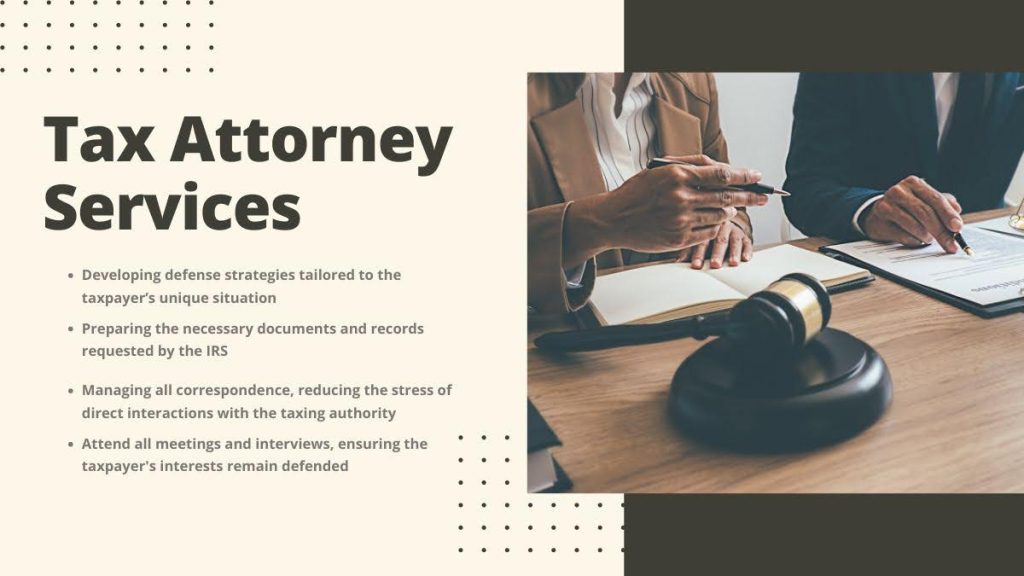

Tax audit representation offered by experienced tax attorneys

The services offered by tax attorneys during the audit process include:

Interpreting the tax audit letter and identifying what the IRS is questioning or seeking.

Preparing documentation and responses to substantiate the taxpayer’s position.

Meeting with the IRS agents to discuss the tax issues raised and to negotiate on the taxpayer’s behalf.

Advising on tax law and potential outcomes, keeping taxpayers informed throughout the process.

The advantages of hiring a law firm for audit defense

The key benefits of engaging a law firm for this purpose include:

Access to a team of tax experts with in-depth knowledge of the tax code and audit procedures.

Professional representation that effectively communicates the taxpayer’s case to the IRS, maintaining the taxpayer’s rights.

The law firm’s ability to navigate through negotiation and appeal processes, potentially reducing penalties or arranging favorable payment terms.

The ability to present and gather evidence efficiently, bolstering the taxpayer’s position throughout the audit.

If you have received a notice from the IRS, don’t delay in contacting our firm. Our tax attorneys are uniquely qualified to handle complex audit issues.

The role of a tax professional in audit representation

The Audit Representation Process: Step-by-Step

Initial consultation

A tax audit representative like our law firm will begin by reviewing your tax returns and financial records to understand your current tax situation. Utilizing their expertise in tax law and the audit process, they’ll assess any potential issues indicated by your audit notice.

Developing a strategy for audit defense

With a thorough understanding of your tax situation, the representative will then devise a strategic defense plan. This involves identifying points of contention, preparing responses, and assembling the necessary documentation to support your case.

Communication with the IRS

Your tax professional will take on the responsibility of communicating with the IRS on your behalf. This includes managing written correspondence, fielding phone calls, and coordinating any meetings required by the audit process.

Representation in audit interviews

If your audit progresses to interviews or negotiations, your tax representative will act on your behalf to present your case and negotiate with the IRS. Their goal is to resolve any disputes and reach a favorable outcome while protecting your rights.

Throughout these steps, the guiding principle of audit representation is to minimize stress for the taxpayer while striving for the most beneficial results under the law.

Benefits of Audit Representation Services

Professional Expertise

Time and Stress Reduction

Potential Cost Savings

Strategic Development and Representation

Assistance with Appeals

Let us handle the IRS while you focus on what matters most. We offer affordable audit representation to individuals and businesses nationwide. Contact us at

(888) 342-9436 for free consultation today.