Yes, a tax attorney can negotiate with the IRS on your behalf,reducing penalties and resolving tax debt.Call our IRS tax relief attorney at (888) 342-9436.

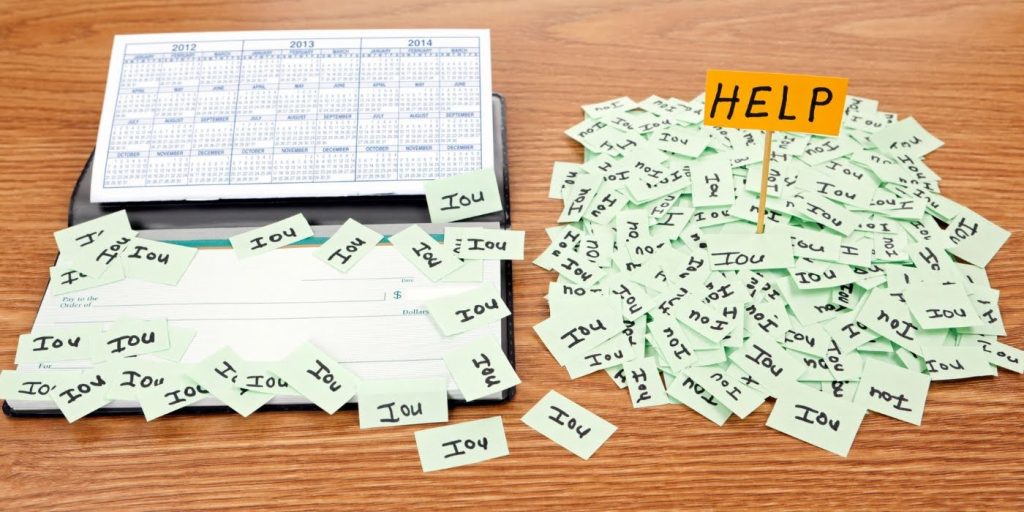

Dealing with the IRS can be overwhelming for any taxpayer, especially when facing decisions that may seem incorrect or unfairly applied. Whether it’s an unexpected tax assessment, a penalty, or a decision on a tax return, the consequences can significantly impact an individual’s financial stability. Understanding your right to challenge these decisions is crucial, as errors and misinterpretations can occur within the IRS. Also, resolving these disputes can protect your financial interests and rights.

With a dedicated team of tax professionals, J. David Tax Law specializes in a broad range of services including IRS Tax Installment Agreements, Tax Debt Resolution, Offers in Compromise, and more. These are all designed to support taxpayers in effectively managing and contesting IRS actions. The firm’s commitment to upholding taxpayer rights and achieving fair outcomes has established it as a trusted partner for many facing challenging interactions with the IRS.

This guide will discuss how J. David Tax Law can assist you in challenging IRS decisions. Including the process of ensuring that your case is handled with the utmost professionalism and expertise.

Taxpayers may find themselves at odds with various IRS decisions, including tax assessments based on perceived underreporting of income or improper deductions. Another common issue involves penalty impositions for late payments on tax dues. Some taxpayers may believe they were unjustly applied due to some circumstances or factual errors in IRS calculations.

Every taxpayer has fundamental rights under the IRS Taxpayer Bill of Rights. It includes the following:

right to be informed,

right to quality service,

right to challenge the IRS’s position

right to be heard.

This framework ensures that taxpayers have the means to know what is expected in the compliance process. Also, the chance to contest discrepancies and provide additional documentation to support their cases.

Complaints against the IRS may be necessary when there are:

Errors in tax calculations that could arise from incorrect data input by IRS systems.

Improper levies or garnishment actions that could financially cripple a taxpayer, especially if these actions were taken based on disputable tax debts.

Denial of deductions or credits without proper justification or due to misinterpretation of tax laws.

Leaving such issues unchallenged can lead to excessive financial burdens, ongoing disputes, and a prolonged state of distress and uncertainty. It may also result in the accumulation of further penalties and interest, significantly increasing the original amount owed.

Review the Decision: Understand the specific reason behind the IRS decision by carefully reviewing the notice or decision letter.

Gather Documentation: Compile all relevant documentation such as tax returns, receipts, letters, and prior communications that support your position.

Submit a Written Complaint: Prepare a clear and concise complaint detailing your disagreement and the relief sought. Include all supporting documents such as your tax payments and notices.

Meet Deadlines: Ensure your complaint is filed within the IRS’s stipulated time frame for responses or appeals to avoid dismissal due to tardiness.

Maintaining thorough documentation is crucial as it forms the foundation of your challenge against the IRS decision. Meeting deadlines is equally important as failing to respond in a timely manner can limit or forfeit your rights to challenge the decision. The role of a tax attorney is crucial in the process to get the resolution that you need.

J. David Tax Law offers specialized services to assist taxpayers in challenging IRS decisions, including:

Tax Audit Representation: Expert defense and negotiation during audits.

Tax Debt Appeals: Assistance in appealing against wrongful tax debt assessments.

IRS Account Investigation: In-depth reviews of IRS account activities to identify and correct discrepancies.

These are just some of the services that J. David Tax Law offers. Their team of skilled tax professionals already handled thousands of clients in the past saving millions in wrongful IRS accusations.

The foundation of avoiding disputes with the IRS starts with keeping clear and accurate tax records. This includes maintaining detailed logs of income, expenses, deductions, and credits throughout the year.

Also, retaining all supporting documentation like receipts, invoices, and bank statements. Proper record-keeping not only supports your tax payments but also prepares you in case your taxes dues are questioned.

Proactively addressing IRS disputes is essential. Taking timely action can prevent minor issues from escalating into more significant problems, which can be time-consuming and costly to resolve. The expertise provided by J. David Tax Law enhances your ability to manage these disputes effectively. Their comprehensive understanding of tax law and IRS procedures ensures that your interests are well-represented and protected.

If you are currently facing challenges with the IRS or if you have any tax-related concerns, don’t hesitate to contact J. David Tax Law. You can surely benefit from its expert guidance and professional representation. Their team is equipped to handle complex tax issues and dedicated to securing the best possible outcomes for their clients. Reach out today to ensure your tax matters are in capable hands.

Our tax relief attorneys specialize in tax problems and tax debt resolutions

Get started with a 100% free consultation

Yes, a tax attorney can negotiate with the IRS on your behalf,reducing penalties and resolving tax debt.Call our IRS tax relief attorney at (888) 342-9436.

Missed the April 15 Tax Day 2025 deadline? Learn about IRS penalties, late payment relief, and how to settle your tax debt. Call us at (888) 342-9436.

IRS grants a tax deadline extension to California wildfire victims.Can you delay filing and payment until Oct. 15, 2025?Call at (888) 342-9436 to find out.

Get IRS Tax Assistance Within 24 Hours