Suddenly, your mailbox holds an unwelcome surprise: a Notice of Federal Tax Lien from the IRS. This notice isn’t just another piece of paper; it’s a legal claim against your properties for unpaid tax debt. Understanding exactly what a Federal Tax Lien is necessary to effectively manage and respond to it. A tax lien can significantly impact your financial well-being, but with the right approach, the situation can be managed effectively. By the end of this article, concepts such as payment plans and appeals will transform from abstract ideas into practical steps you can take to secure your financial freedom.

What is a Federal Tax Lien?

A federal tax lien is the legal claim by the United States government against the assets of an individual or business entity that has failed to pay tax debts. The lien comes into force when the Internal Revenue Service (IRS) assesses a tax liability against a taxpayer, sends a Notice and Demand for Payment, and the taxpayer neglects or refuses to satisfy the debt.

For taxpayers dealing with gift tax liens or special liens related to estate taxes, these arise at particular events and are governed by separate rules under federal tax regulations. It is essential to note that typical federal liens do not need the consent of the debtor and are not the same as consensual liens that arise from contracts such as mortgages or car loans.

Importance of Receiving a Notice

The filing of a Notice of Federal Tax Lien (NFTL) is a public act – often taking place at the office of the county recorder or county clerk – and serves as a formal warning to other current or prospective creditors. The Notice does not establish the lien itself; the lien is created by law after the IRS assesses the debt, makes a demand for payment, and the taxpayer does not fully pay within a given time frame. However, the filing of the Notice outlines the government’s right to assets over other creditors and is an important step in protecting the IRS’s interest.

Receiving an NFTL prompts urgent attention to the issue at hand. For taxpayers, an NFTL is a signal that the IRS may take further collection action, and it may restrict their ability to use assets for securing a business loan or other financing. To resolve the matter, taxpayers can either pay the outstanding tax balance in full or explore other options such as a lien discharge, subordination, or making an installment agreement. In certain cases, if the IRS considers it will facilitate the collection of the tax, they may withdraw the lien.

Assessing Financial Situation

Once the Internal Revenue Service (IRS) files the Notice of Federal Tax Lien (NFTL), they announce to creditors the federal government’s legal right to your assets. Be informed, paying the tax debt in full is the most efficient and direct path to removing the lien. Once full payment is confirmed, the IRS will release the lien within 30 days. However, if complete payment isn’t an immediate option, there are other IRC provisions available that may help alleviate the impact of a lien on your property and financial well-being.

Reviewing the Tax Assessment

The beginning of your resolution journey involves a careful review of your tax assessment. If the IRS files an NFTL, it’s paramount to ensure that the notice reflects the actual tax obligations. Inaccuracies or premature filings can be contested, and requests for post-release NFTL withdrawals will generally be granted when it is proven that the filing was not in accordance with IRS procedures.

Under IRC 6323(j)(1)(D), post-release NFTL withdrawals are likely to be approved if you can showcase that you’ve fully settled the liabilities listed. Settlement can take the form of payment, credit offset, amendment of returns, innocent spouse relief, or fulfillment of an offer in compromise. In specific, extenuating circumstances, the IRS may provide additional leniencies, as detailed in SBSE-05-1212-104.

For estate tax liens, bear in mind that IRC § 6324(a)(2) imposes a different collection framework, stipulating a separate 10-year period to resolve the estate tax liabilities from the time the estate tax return is filed.

Evaluating the Amount of Debt

Understanding and evaluating the amount of debt you owe is critical after reviewing the assessment. The IRS will provide you with a bill outlining the debt when the federal tax lien process begins. Importantly, this debt encompasses all present and future assets, extending to securities, vehicles, any business-related property, and even rights to business property, during the lien’s existence.

Assessing Your Assets

Asset Overview: Start with a thorough assessment of all assets, including Personal Property and Real Estate. Under Federal Tax Liens, these can be subjected to liens, affecting everything from business assets like Accounts Receivable to newly acquired property.

Real Estate Risks: Real estate assets can be particularly vulnerable. Federal Liens may override other claims such as mortgages, depending on the Actual Notice filed by the County Recorder. Accurate IRS Tax Lien Lookup is essential to understand any liens tied to your properties.

Business Asset Impact: For businesses, all assets and loans are at risk if there are outstanding Tax Assessments and demands for payment. Each day a lien remains unresolved increases the financial risk.

Lien Complexities: Both federal and state liens, including Sales Tax Liens and State Created Liens, complicate asset management. Understanding the specifics of Federal Tax Lien Payoff Requests is crucial.

Protecting Assets: In places like North Carolina, where local laws impact lien status, proactive engagement with legal experts is vital. This helps navigate issues involving Junior Liens, Special Liens, and other lien types affecting your assets.

Exploring available Options

There are several available options that taxpayers can pursue to address this situation. A lien is a legal claim to safeguard the government’s interest in an individual’s property until the tax liability is met. With this knowledge, taxpayers can explore a variety of legal strategies and solutions to effectively manage or resolve their Federal Tax Liens. These options include negotiating a payment plan, requesting an Offer in Compromise, setting up an installment agreement, applying for financial hardship relief, and considering the outcome of bankruptcy on their federal tax lien situation.

Negotiating a Payment Plan

Taxpayers who find themselves unable to pay their tax debt in full may consider negotiating a payment plan as a viable solution. Payment vouchers are available for those preferring to make tax payments by mail; individual vouchers correspond to specific tax types and can be found in the IRS’s Forms Repository.

Creating a payment plan with the IRS can assist in managing the debt over time, thereby steering clear of more severe consequences that come with federal tax liens. It is essential to remember, however, that while a payment plan may mitigate some of the pressures, the lien generally remains in place until the tax obligation is fully satisfied or other specific conditions are met.

Requesting an Offer in Compromise

An Offer in Compromise (OIC) presents an opportunity for taxpayers to settle their tax liabilities for less than the amount owed. To be eligible to request an OIC, taxpayers must fulfill all tax liabilities listed on the Notice of Federal Tax Lien. This resolution can occur through payment, credit offset, return amendments, innocent spouse relief, or an OIC acceptance.

However, tax debts discharged during bankruptcy or those that fall under expired collection statutes are not considered ‘fully satisfied.’ A crucial step after satisfying the liabilities is obtaining a Certificate of Release which enables a post-release NFTL withdrawal in line with IRC 6320(j)(1)(D). It’s noteworthy that post-release NFTL withdrawals for self-releasing liens are typically not granted without significant extenuating circumstances, detailed in IRS documentation.

Setting Up an Installment Agreement

Entering into an installment agreement with the IRS might enable the taxpayer to manage their tax liability and, under certain circumstances, result in a withdrawal of the Notice of Federal Tax Lien. Following the Service’s policy expansion in April 2011, withdrawals for taxpayers entering into Direct Debit Installment Agreements may be allowed, assuming specific conditions are adhered to.

Installment agreements offer a structured approach for tax liability repayment over time, which can be particularly appealing for those seeking to minimize the impact of a federal tax lien on their credit and financial standing. To progress with this option, a taxpayer must set up the agreement and comply with its terms.Here’s a summary of key aspects of an Installment Agreement:

Taxpayers can negotiate monthly payment amounts that fit their budget, spreading the tax debt over several months or years.

While the agreement is in place, interest and some penalties continue to accrue on the outstanding balance, although at a reduced rate compared to the penalties for not paying at all.

Generally, taxpayers must file all required tax returns and meet specific criteria regarding their tax debt amount to qualify.

Once an agreement is established, aggressive collection actions such as levies and garnishments are halted, as long as the taxpayer complies with the terms of the agreement.

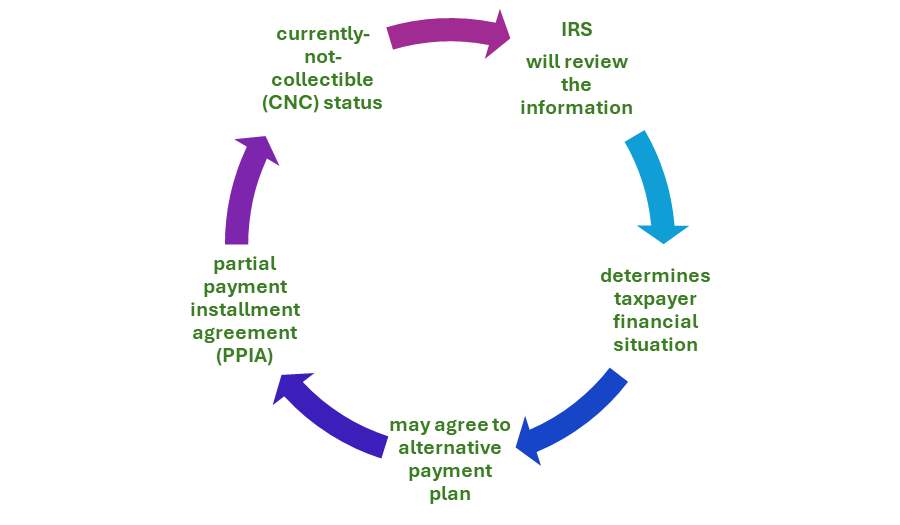

Applying for a Financial Hardship

In cases where taxpayers are unable to pay their tax debts immediately and are at risk of a tax lien, they may have the option to apply for a financial hardship. A financial hardship occurs when a taxpayer’s ability to meet their basic living expenses is significantly impaired due to their tax debt.

Under certain circumstances, the IRS may consider waiving the filing of a tax lien if the taxpayer can demonstrate that they are experiencing a genuine financial hardship. When applying for a financial hardship, taxpayers will need to submit a Collection Information Statement (Form 433-A or Form 433-F) to the IRS. This form requires taxpayers to provide detailed information regarding their income, assets, expenses, and liabilities. It is essential to be thorough and accurate when completing this form to portray an accurate representation of the financial hardship.

Considering Bankruptcy

Considering bankruptcy should always be viewed as a last resort due to its significant long-term consequences. While it can prevent a tax lien from attaching to newly acquired property post-bankruptcy, it does not erase the government’s ability to collect on existing debts through other means. Additionally, bankruptcy can severely impact your credit score, limiting your ability to obtain loans, credit cards, and even affecting future employment opportunities. It also remains on your credit report for up to 10 years, making financial recovery a challenging and prolonged process. Furthermore, not all tax liabilities are dischargeable in bankruptcy, meaning certain tax debts may persist even after the proceedings are completed, continuing to affect your financial situation.

Protecting Your Assets

Protecting your assets is not simply about responding to liens; it involves proactive management and understanding how to limit potential damage. Setting up alerts for changes in your credit report, maintaining meticulous financial records, and understanding the implications of tax laws on your estate are integral steps in safeguarding your interests and minimizing the impact a lien might have on your personal or business holdings. Apart from the immediate actions you can take when faced with a federal tax lien, protecting your assets requires ongoing proactive management.

Here’s a detailed look at strategies to safeguard different types of assets:

1. Real Estate Protection

Purchase title insurance to protect against any unknown liens or disputes over property ownership.

Utilize homestead exemptions where available to protect a portion of your home’s value from creditors.

Hold property in legal structures that may offer protection, such as trusts or limited liability entities.

2. Business Asset Safeguarding

Keep personal and business assets separate to shield personal assets from business liabilities.

Choose the right business structure (e.g., LLC, Corporation) that provides liability protection for personal assets.

Invest in comprehensive insurance policies, including general liability, professional liability, and excess liability coverage.

3. Protection of Personal Property

Title significant assets (like vehicles) in a way that protects them from potential legal threats.

Consider an umbrella insurance policy to cover liabilities that go beyond the limits of standard insurance policies.

4. Financial Asset Defense

Diversify your investments to mitigate risks and shield your portfolio from volatility.

Maximize contributions to retirement accounts, which are often protected from creditors under federal law.

Engage in estate planning, including the use of trusts, to manage and protect your financial legacy.

5. Intellectual Property (IP) and Digital Assets

Register patents, trademarks, and copyrights to secure your intellectual creations.

Implement robust digital security measures to protect sensitive information and digital assets like cryptocurrencies.

6. Legal and Tax Advice

Stay compliant with tax obligations to avoid liens and penalties.

Regularly consult with legal professionals to ensure all protective measures align with current laws and best practices.

If you need legal advice call us today at (888) 342-9436. We offer affordable tax representation to individuals and businesses nationwide seeking relief from Federal tax liens.

7. Strategic Financial Management

Maintain a strategic approach to managing debt to prevent overwhelming liabilities.

Build and maintain an emergency fund to provide a financial buffer against unexpected financial disruptions.