Facing IRS tax debt? J. David Tax Law offers six strategic approaches to manage and resolve this burden effectively. This blog will guide you through these strategies, which tackle various aspects of IRS tax debt resolution, from thorough assessments to strategic payment negotiations and beyond. These strategies are not just about reducing debt—they’re about restoring financial control and ensuring future tax compliance. By understanding and implementing these approaches, you can set a course toward lasting financial health and peace of mind.

Comprehensive Assessment of Tax Liabilities

The process of resolving IRS tax debt starts with a detailed review of the entire tax situation. J. David Tax Law examines all unpaid taxes, penalties, interest, and any notices or audits to fully understand the liabilities. This detailed review is essential for planning the right steps to manage and resolve IRS tax debt and sets the stage for everything that follows. Here are the steps of a comprehensive assessment:

Evaluation of Total Tax Debt

The initial step involves a detailed review of all outstanding financial obligations, including taxes, penalties, and accrued interest. This ensures a clear understanding of the total IRS tax debt, forming the basis for all negotiation and resolution strategies.

Understanding Notices and Audits

A thorough analysis of any communications from the IRS, such as notices or audit details, is crucial. This ensures that each resolution strategy is informed by the latest interactions and requirements set by the IRS. This analysis is tailored to fit each unique case.

If you are being pursued by the IRS due to findings during a tax audit, call at (888)342-9436 the tax attorneys at J David Tax Law.are happy to assist.

Identifying Relief Options

Identifying potential relief options is a key part of the assessment for IRS tax debt. This includes exploring possibilities for penalty abatement, negotiating offers in compromise, or setting up installment agreements that align with the taxpayer’s financial capabilities. Each option is considered based on its potential to reduce the IRS tax debt effectively.

This comprehensive assessment establishes a foundation to ensure that all strategies developed for tackling IRS tax issues are informed, effective, and tailored to the specific needs and capabilities of the taxpayer.

Negotiation of Payment Plans

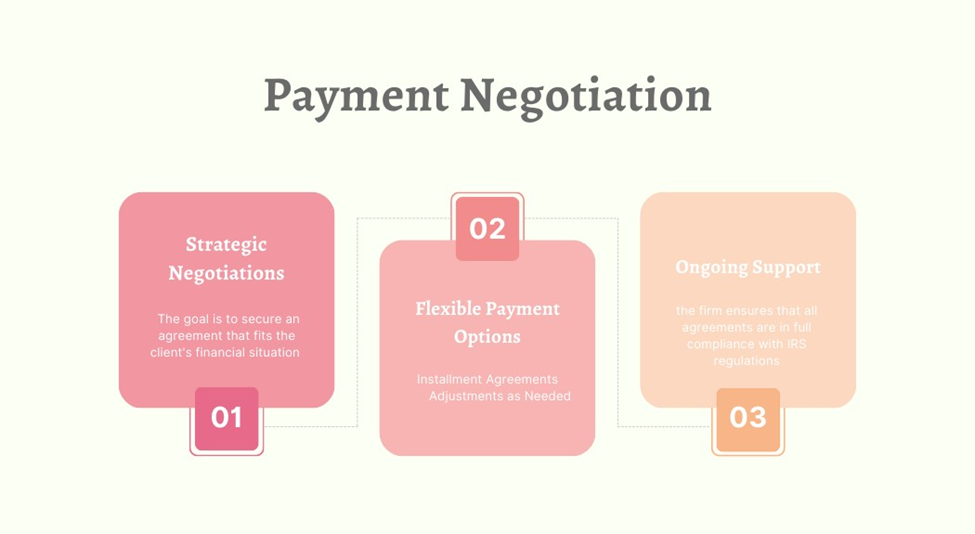

Following the comprehensive assessment, J. David Tax Law engages in setting up negotiations with the IRS to establish payment plans that are compatible with the client’s financial status. This process is critical to ensuring compliance with tax laws while minimizing financial burden on clients. Here’s a detailed breakdown of how these negotiations are handled:

Strategic Negotiations

With the financial assessment complete, the firm approaches the IRS to discuss feasible payment options. The goal is to secure an agreement that fits the client’s financial situation without causing undue strain.

Flexible Payment Options

Installment Agreements: These allow clients to pay their IRS tax debt over time in smaller, more manageable amounts.

Adjustments as Needed: Recognizing that financial situations can change, the firm remains flexible, ready to adjust payment plans in response to new financial realities.

Ongoing Support and Compliance

Throughout the process, the firm ensures that all agreements are in full compliance with IRS regulations, providing clients with stability and peace of mind.

Penalty Abatement Requests

If suitable, the firm assists in filing for penalty abatement to reduce the total amount owed, arguing the case based on reasonable cause or specific exceptions. This step not only helps lower the immediate financial burden but also impacts future financial commitments by potentially reducing future penalties. Here’s how the firm supports clients in reducing these penalties:

Understanding Penalty Abatement Options

J. David Tax Law educates clients on the two primary forms of penalty abatement:

First Time Penalty Abatement

Reasonable Cause Penalty Abatement.

The firm guides clients through the qualifications for each, focusing on their specific tax history and the circumstances that led to penalties.

First Time Penalty Abatement

For clients with a history of compliance, a request for First Time Penalty Abatement can be submitted to the IRS. This option is available if the client has filed all returns and paid all taxes on time for the previous three years prior to the year in which the penalty occurred.

Reasonable Cause Penalty Abatement

If the client does not qualify for the First Time Penalty Abatement, pursuing penalty abatement based on reasonable cause is the next step. The firm assists clients in documenting and proving circumstances like natural disasters, severe illness, or other significant disruptions that prevented timely filing or payment

Filing the Request

Requests for penalty abatement are submitted using IRS Form 843, where the taxpayer must detail the tax period and penalties they seek to abate and provide a rationale for the request. J. David Tax Law handles the preparation and submission of this form, ensuring all details are accurately represented.

Maximizing Outcomes

By effectively arguing for the abatement of penalties and the associated interest, J. David Tax Law aims to reduce the overall financial burden on the taxpayer, easing their path to tax compliance and financial stability.

Offers in Compromise

An Offer in Compromise allows taxpayers to settle their tax liabilities for less than the full amount owed, providing a crucial lifeline for those unable to meet their tax obligations in full. For clients who qualify, an Offer in Compromise is prepared and submitted to the IRS, proposing a reduced amount to settle the entire tax debt. Here’s a detailed overview of how this process is facilitated:

Financial Assessment

A thorough review of the taxpayer’s financial records is conducted to assess their ability to pay. This includes analyzing income, expenses, and asset equity to determine a reasonable collection potential, which helps in setting a feasible offer amount that reflects the taxpayer’s current financial situation.

Submission of the Offer

The application for an Offer in Compromise is carefully prepared, including all required documentation to substantiate the taxpayer’s financial status and justification for the reduction. This includes completing the necessary IRS forms, such as Form 656.

IRS Negotiations

Negotiations with the IRS are a critical step. Expertise in tax law and IRS procedures is utilized to argue for the lowest possible settlement that is both fair and reflective of the taxpayer’s economic reality.

Choosing Payment Options

Taxpayers are guided in choosing between a lump-sum or a structured payment plan. The lump-sum option requires a 20% upfront payment and settlement of the balance within five months, while the structured plan spreads payments over 24 months.

Handling Fees and Qualifications

Assistance is provided in managing the application fee, and for those meeting the low-income criteria, this fee along with the initial payment requirements can be waived, making the process more accessible.

Ongoing Support

Throughout the process, support is given to ensure that all IRS communications are addressed, and that the taxpayer remains compliant with tax laws, thereby avoiding new liabilities during the review period.

To see the positive impact of these efforts, review the offer in compromise success stories of taxpayers who have effectively managed their tax challenges with professional guidance.

Legal Representation

Handling interactions with the IRS can be challenging. J. David Tax Law offers strong legal representation to manage audits, appeals, and court proceedings effectively. This level of legal expertise ensures that all dealings with the IRS are conducted professionally, helping clients address complex tax issues with confidence and ensuring their rights are well protected.

Preventive Advice and Future Tax Planning

Beyond resolving current tax issues J. David Tax Law offers advice to prevent future problems and strategic planning for future tax obligations. This step prepares for better management of upcoming tax situations and may lead back to the initial assessment phase as new fiscal years approach and new tax obligations arise. Learn more about how J. David Tax Law effectively addresses the three most common complaints encountered when dealing with the IRS, including lengthy response times, complex tax laws, and challenging dispute resolutions.