Facing an IRS audit, tax fraud charge, or business tax dispute? Protect your rights with a skilled tax litigation attorney. Call us today at (888) 342-9436

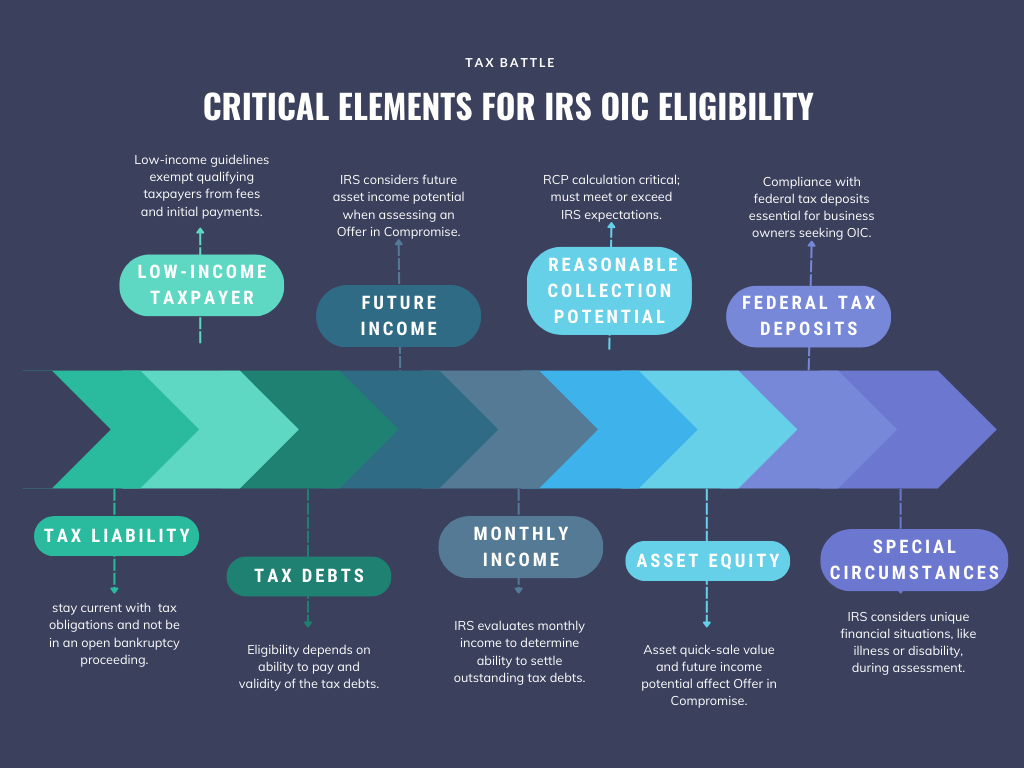

Tax battles can drain your resources and overshadow your daily life, especially when they involve significant tax debts, asset equity concerns, and the looming threat of collection activities. An IRS Offer in Compromise (OIC) offers a practical resolution to these challenges, allowing you to settle tax liabilities for less than the full amount owed. Engaging in this process can be a legitimate option for those overwhelmed by basic living expenses and exceptional circumstances.

This isn’t just about reducing debts—it’s about securing a financial future free from the grip of past tax returns and ongoing federal tax deposits.

An IRS Offer in Compromise (OIC) is essentially a settlement agreement between a taxpayer and the IRS. This arrangement allows individuals or businesses to settle their tax debts for less than what they actually owe. It is considered a legitimate option for those who are experiencing financial difficulties and cannot fully pay their tax liabilities, or for whom doing so would create financial hardship.

The OIC program serves as an alternative for taxpayers who have exhausted other payment options, such as installment agreements or temporarily delaying collection due to hardship. It’s a rigorous application process that requires a non-refundable application fee and a submission of Form 656-B, unless the taxpayer qualifies as a low-income taxpayer. Those contemplating

an OIC should be aware that they must continue to stay compliant with all filing and payment obligations and that this debt resolution method puts future income under examination.

Feature | IRS Offer in Compromise (OIC) | Other Payment Options |

Purpose | To settle tax debts for less than the full amount owed | To arrange payment of the full tax debt over time |

Eligibility Criteria | Must meet strict criteria including inability to pay full tax liability due to financial hardship | Generally available to most taxpayers with outstanding taxes |

Application Process | Involves submitting Form 656, proving financial hardship, and using the Compromise Pre Qualifier Tool | May involve setting up an Installment Agreement or requesting a temporary delay of collection |

Impact on Tax Liability | Can significantly reduce the amount of taxes owed | Does not reduce the tax liability; may include penalties and interest |

Initial Payment | Requires an initial payment as part of the application process | Initial payment varies by plan; installment agreements typically require a setup fee |

Monthly Income Consideration | Must demonstrate that income is insufficient to cover the tax owed and basic living expenses | Income is evaluated to determine payment plan amounts and duration |

Special Circumstances | Takes into account exceptional circumstances that affect ability to pay | Less flexible, though some plans consider living expenses and other financial obligations |

Duration | Once accepted, can resolve the tax debt quickly depending on the proposed offer | Typically extends payments over several years, depending on the total debt and payment plan |

A Comparison of OIC and other payment options

Determining whether you qualify for an IRS Offer in Compromise (OIC) requires a close examination of your financial situation to ensure compliance with IRS guidelines. The following elements are critical in the IRS’s assessment of your eligibility:

While some individuals may feel comfortable handling routine communications with the IRS, there are situations where hiring a tax attorney becomes not just beneficial but necessary.

Criteria for Deciding When Professional Help is Necessary:

Complexity of the Tax Issue: If you’re dealing with complex tax issues, such as international tax matters, large sums of money, or business taxes, professional help can be invaluable.

Amount at Stake: The higher the financial stakes, the more prudent it is to hire a professional. Mistakes can be very costly when large amounts of taxes or penalties are involved.

Audits: If you are notified of an IRS audit, hiring a professional is advisable. Tax professionals can help prepare the required documents, accompany you to meetings, and interact with auditors on your behalf.

Previous Tax Disputes: If you have had tax disputes in the past, or if there have been complications with your tax filings, a tax professional’s guidance can help you avoid future issues.

Peace of Mind: Sometimes, the decision to hire a licensed tax professional comes down to wanting assurance that an expert is handling your case. Especially if the tax laws have changed recently or if your financial situation is complicated.

Understanding the interaction between state and local tax laws in Charlotte and federal tax obligations is crucial for any taxpayer. This knowledge not only ensures compliance but also helps in optimizing tax liabilities.

For instance, Charlotte NC may have specific tax credits and deductions that can affect your federal tax returns. Ignorance of these laws can lead to costly mistakes or missed opportunities. Therefore, staying informed about these local regulations is vital to managing your overall tax burden effectively.

To stay updated on local tax issues, consider subscribing to newsletters from the North Carolina Department of Revenue or the local Charlotte government’s finance department. These resources often provide important updates on changes in tax law, upcoming deadlines, and new tax incentives.

Effective communication with the IRS is paramount during tax negotiations. Clear and timely communication can prevent misunderstandings, reduce tax penalties, and often lead to a more favorable outcome. It’s important to respond to IRS notices and requests for information promptly to show your willingness to cooperate. This can positively influence the course of negotiations to settle your tax debt.

Always ensure that your communications are concise, factual, and supported by documentation, which speaks directly to the points at issue.

Starting the process to resolve tax debts through an IRS Offer in Compromise (OIC) is a critical step toward financial recovery. This option allows taxpayers to settle their tax liabilities for less than the full amount owed by carefully evaluating their monthly income, basic living expenses, and asset equity. The IRS thoroughly examines each proposal to ensure it represents the maximum reasonable collection potential. Applicants should be prepared for a rigorous application process, providing comprehensive documentation of their financial situation. Success in this initiative depends on precise documentation, straightforward communication, and a proactive approach to working with the IRS to achieve a manageable compromise.

The IRS Offer in Compromise (OIC) application process is thorough and demanding. The IRS closely examines every detail of your financial situation, including monthly income, basic living expenses, and existing liabilities. While the idea of settling your debts for less than what you owe might seem appealing, it’s crucial to recognize that the standards for qualifying are strict. Many applications are rejected because they do not meet the IRS’s stringent criteria. Therefore, an OIC should be considered a viable option only for those who genuinely fulfill these stringent conditions and not as a universal solution for all tax debtors. Let the experts at J. David Tax Law guide you through every step of the process.Contact us at (888) 342-9436 today to ensure you meet all the necessary criteria and maximize your chances for a favorable resolution.

The Compromise Pre-Qualifier Tool is essential for anyone considering an IRS Offer in Compromise (OIC). This online tool helps you assess your eligibility by analyzing your tax liabilities, monthly income, and asset equity. It provides a solid foundation for your preliminary proposal, clarifying your potential outcomes and ensuring you are well-prepared for the OIC application process.

Choosing the right payment option—either a Lump Sum Cash or Periodic Payment offer—is crucial in demonstrating your commitment to resolving your tax debts through an OIC. The initial payment, whether 20% for lump sum or the first installment for periodic, is nonrefundable but is applied towards your tax liability if your offer is accepted.

Each OIC submission incurs a $205 application fee, though this can be waived for low-income taxpayers under financial strain. This fee, along with the initial payment, must be included with your OIC package, and eligibility for any waivers can be verified through Form 656-B.

Submitting a complete and accurate compromise application is crucial, as the IRS often rejects applications that fail to meet all requirements. The process involves detailed financial documentation and adherence to the stipulated initial payment and application fee, particularly crucial for low-income taxpayers.

Form 656-B, the Offer in Compromise Booklet, is your comprehensive guide through the OIC process. It includes all necessary forms and instructions, making it an indispensable tool for applicants. This booklet helps clarify the OIC eligibility criteria and guides you through assembling a thorough application.

Be wary of “OIC mills” that promise easy solutions to tax debt. These operations prey on desperate taxpayers, often leading to wasted funds and unfulfilled promises. The IRS advises caution, noting these scams in their “Dirty Dozen” list of tax scams.

Creating a strong preliminary proposal is a vital step in the OIC process. Utilizing the Compromise Pre-Qualifier Tool as a guide, your proposal should reflect a realistic and comprehensive view of your financial situation, improving your chances of a successful negotiation with the IRS.

While your OIC is under review, the IRS generally suspends other collection activities, providing a temporary reprieve. However, this period may include the placement of a federal tax lien and extends the timeframe for collection, highlighting the importance of considering these factors when applying for an OIC.

If your OIC is denied, you can file a request for appeal. This step allows you to contest the decision based on specific discrepancies or hardships, arguing that your offer fairly reflects your ability to pay while considering the IRS’s collection needs.

Come see how we can help you file a compelling Request for Appeal, backed by our track record of success stories.

Engaging in negotiations for an IRS Offer in Compromise (OIC) is a pivotal step towards securing a more manageable financial situation. This process provides a pathway for qualified taxpayers to settle their tax debts for less than the full amount due, effectively alleviating financial strain. Success in these negotiations hinges on convincingly demonstrating economic hardship that prevents full payment of the tax liability.

In calculating an appropriate offer amount for an IRS Offer in Compromise (OIC), the taxpayer and the IRS evaluate numerous financial variables. The IRS considers the taxpayer’s ability to pay, examining monthly income, basic living expenses, and asset equity. It’s crucial to show that paying the full tax debt would cause significant economic hardship. Taxpayers should present a strong case with solid figures, potentially supported by low-income certification if applicable. Options include a Lump Sum Cash offer, which requires a 20% nonrefundable upfront payment, or a Periodic Payment offer, extending over 24 months. The goal is to demonstrate that the proposed offer reflects the highest amount reasonably collectible by the IRS, aligning with the Reasonable Collection Potential.

The IRS provides two main payment options for an OIC: Lump Sum Offer and Periodic Payment Offer. The former requires a 20% initial payment with the balance due within five months of acceptance, while the latter involves an initial payment followed by installments over up to 24 months. To qualify, taxpayers must ensure they are current with their tax filings and payments. The Compromise Pre-Qualifier Tool is a critical resource for assessing eligibility and preparing for the offer submission, confirming that all prerequisites are met.

Tax filing status significantly influences the OIC process. Taxpayers use the IRS Pre-Qualifier Tool to input their financial and filing details to determine a suitable offer. For those questioning their tax liability, Form 656-L may accompany the primary Form 656 application. Taxpayers below the low-income cutoff may be exempt from certain fees according to Form 656 guidelines. It’s essential to provide accurate data on IRS Forms 433-A and 433-B OIC to ensure correct assessment of both individual and business tax contexts.

Reviewing basic living expenses is vital in the OIC evaluation to ensure the proposed offer is feasible. This review requires taxpayers to clearly detail their living expenses, proving that the financial strain from the tax debt is considerable. Successfully demonstrating these expenses is crucial for obtaining IRS approval and realistically managing future financial obligations. Through an OIC, taxpayers can aim to reduce their tax burden significantly if they can confirm that the hardship is substantial.

Has your IRS Offer in Compromise been rejected? Don’t lose hope! At J. David Tax Law, we specialize in turning these challenges into successful resolutions.Our tax relief attorneys specialize in tax problems and tax debt resolutions

Get started with a 100% free consultation

Facing an IRS audit, tax fraud charge, or business tax dispute? Protect your rights with a skilled tax litigation attorney. Call us today at (888) 342-9436

Are you facing IRS penalties? See how penalty abatement could help reduce your financial stress. Call (888) 342-9436 to talk with J. David Tax Law today!

Denied Non-collectible status? Learn the appeals process and secure your financial relief with J. David Tax Law. Call (888) 342-9436 for free consultation.