Facing an IRS audit, tax fraud charge, or business tax dispute? Protect your rights with a skilled tax litigation attorney. Call us today at (888) 342-9436

Receiving an IRS audit notice can raise concerns, even for the most diligent taxpayers. An IRS audit scrutinizes your financial records and tax returns, often leaving individuals wondering why their accounts were selected for such thorough examination. Audit defense services act as a crucial safeguard, ready to defend your interests against additional taxes and penalties. With skilled audit representation, you can shift from anxiety to peace of mind.

This article provides clear insights into the audit process and the value of effective audit defense. By the end, you’ll be well-prepared with robust tax audit representation to confidently address IRS scrutiny.

An IRS tax audit rigorously examines the information submitted on a taxpayer’s returns to ensure its accuracy. The IRS evaluates financial records to verify that the appropriate amount of tax has been paid and that the law has been followed. In the United States, taxpayers are expected to accurately report their earnings and deductions. However, the IRS conducts audits as a means to catch human errors or intentional inaccuracies, typically within a 3 to 6-year period after filing.

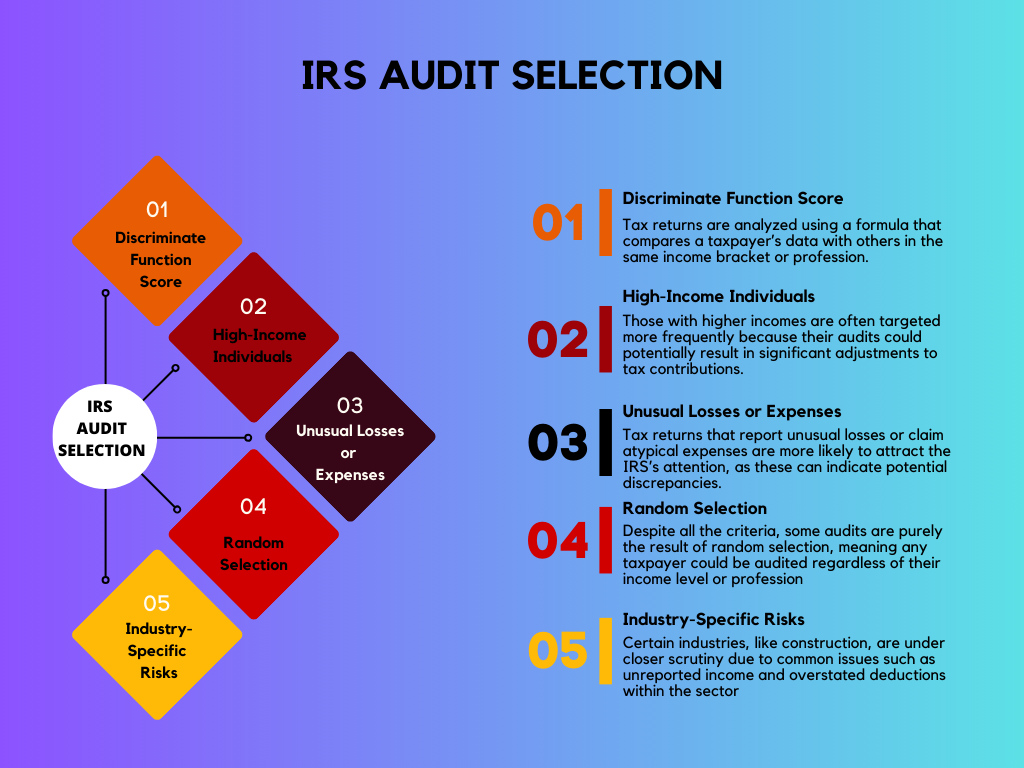

The IRS uses a strategic approach to determine which taxpayers are audited. Here are the main reasons some individuals and businesses might find themselves under review:

When the IRS decides to conduct an audit, they can choose from four main types, each varying in its intensity and approach. For small business owners, the difference between the types of audits can be significant and may influence their preparation and response strategies:

Correspondence Audits

The simplest form, which is usually carried out through the mail and focuses on specific item discrepancies.

Office Audits

These require the taxpayer to come into an IRS office, bringing with them supporting documentation for one or several items on their return.

Field Audits

The most comprehensive type, where IRS agents visit the taxpayer’s place of business to conduct a thorough review of all records.

Taxpayer Compliance Measurement Program Audits

Arguably the most extensive and detailed, these audits require every item on the tax return to be substantiated.

Income tax audits, though infrequent, can profoundly impact a taxpayer’s finances, with the IRS often targeting high-income earners. In 2018, the IRS identified over $9 billion in additional taxes due from individual audits. Engaging audit protection services offers essential peace of mind by providing expert representation and managing documentation for a fixed fee.

When it comes to business audits, complexity and cost can vary widely:

· Simple Audits: Delving into basic deductions might total less than $3,000.

· Moderate Audits: For businesses with activities like freelancing or rentals, expect expenses from $3,000 to $6,000.

· Complex Audits: Large-scale business audits can exceed $7,500, considering deeper issues like undeclared revenue or payroll discrepancies. Legal proceedings, like appeals or Tax Court cases, could accrue fees from $5,000 onwards, with substantial retainers customary when beginning case work.

Audit defense services are critical for effectively managing the challenges of an IRS audit. These services, provided by experienced tax professionals such as Enrolled Agents, CPAs, and tax attorneys, ensure accurate representation of tax returns and robust defense against audits. Need a strong ally in your corner for an IRS audit? Contact our team of skilled tax attorneys at J. David Tax Law or call us at (888) 342-9436 today.

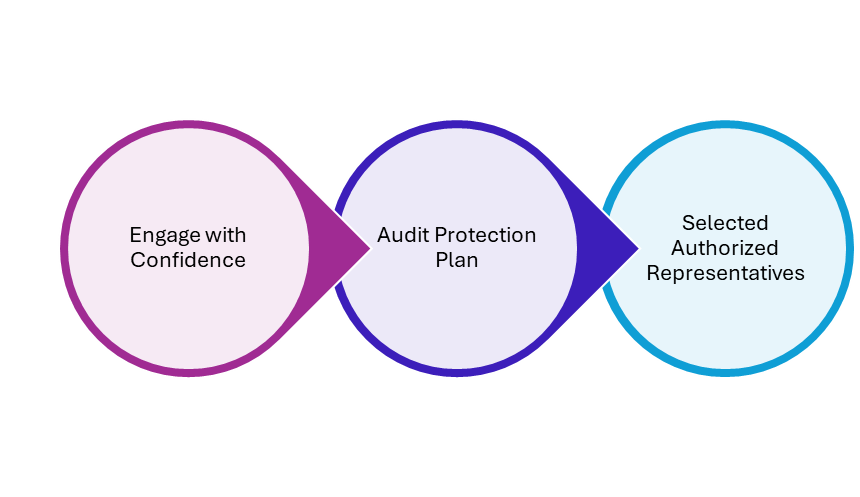

Audit defense, known as tax audit representation, serves as a taxpayer’s frontline protection against the IRS’s probing eyes. This service is provided by tax professionals who boast the authority to practice before the IRS. Commonly, audit defense services offer coverage for a specified time frame, typically up to three years from the submission date of an IRS-approved tax return. However, this period can be extended if substantial errors are detected.

Gain access to experienced tax professionals like CPAs and tax attorneys who expertly manage the audit process.

Reduce anxiety associated with IRS audits by having experts handle complex audit situations.

Prepaid audit defense plans ensure preparation for audit challenges, enhancing the likelihood of favorable outcomes.

Maintain accurate financial records and tax returns, protecting against potential additional taxes and penalties.

Minimize financial risks from audits by ensuring your tax affairs are thoroughly reviewed and defended.

The role of a tax professional in audit defense is invaluable. Equipped with specialized knowledge of tax laws and IRS procedures, these experts provide crucial support during audits. They not only prepare and review your financial documentation to ensure accuracy and compliance but also represent and advocate for you in discussions with the IRS

Hiring a tax professional is a strategic decision for taxpayers looking to ensure accuracy and compliance with complex tax laws. They can identify potential tax credits and deductions, reducing overall tax liabilities effectively. Additionally, in the event of an IRS audit, having a skilled tax expert by your side can make a significant difference in managing the process smoothly and defending against additional taxes or penalties.

When facing the possibility of an audit, the caliber of your tax professional can significantly impact whether the process is straightforward or fraught with difficulties. Here are the key qualities you should look for:

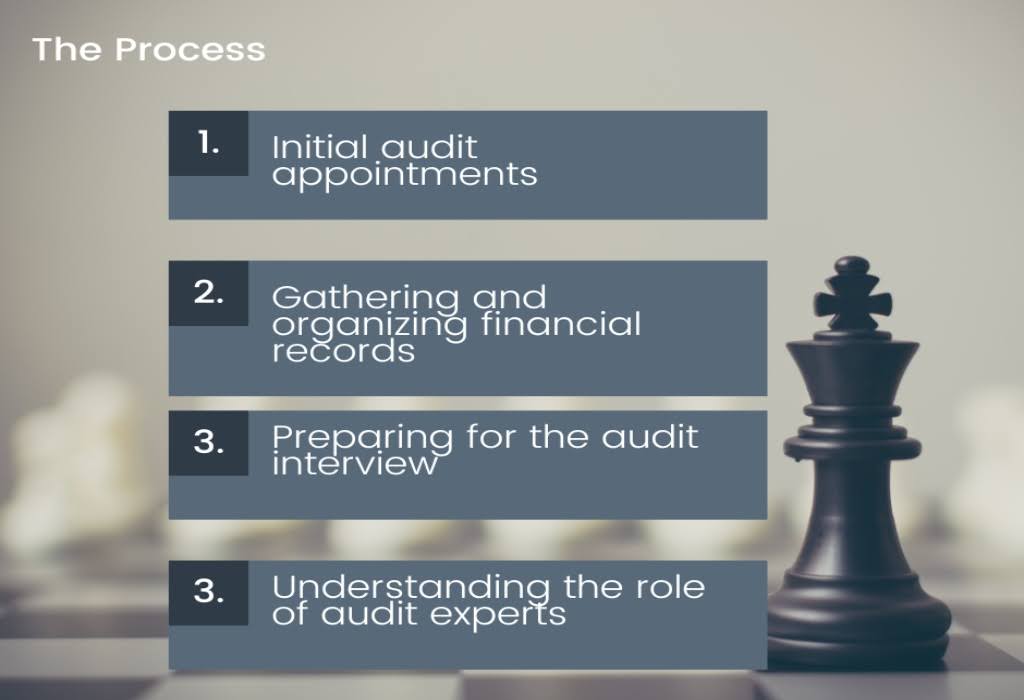

The initial IRS appointment is crucial for setting the tone of the audit defense, requiring a thorough understanding of IRS regulations and skillful presentation of organized documentation. Comprehensive preparation of financial records demonstrates commitment to compliance, potentially limiting further IRS investigation, while familiarity with audit procedures ensures the protection of taxpayer rights.

Effective audit defense begins with meticulous organization of financial records, which strengthens the taxpayer’s case and communicates precision and regular financial upkeep.

Detail in financial documentation is critical, as each record can significantly influence the negotiations, setting the tone and pace of the audit.

Face-to-face interviews with the IRS scrutinize reported income, expenses, and deductions, providing taxpayers an opportunity to address discrepancies. Tax professionals guide clients through these interviews, balancing transparency with caution to avoid expanding the audit’s scope unnecessarily.

Tax audit experts lead the defense, strategically preparing and communicating with the IRS to ensure a fair audit process. These experts utilize their deep knowledge of tax laws and industry standards to advocate effectively, ensuring transparency and fairness in audit dealings.

Looking for expert tax audit and assessment services? Visit J. David Tax Law for top-tier audit defense from our team of skilled Tax attorneys.

Audit protection services are a vital measure to consider before filing your tax returns. Given that these services often have a set coverage period, it’s important to secure them ahead of your filing. Although the chance of facing an IRS audit is relatively low at about 0.5% annually, the potential complexities and costs of being audited make investing in audit defense worthwhile.

These programs provide comprehensive support, including third-party representation, assistance with vital documents, and the insights of experienced professionals. For tax practitioners, adding audit protection services enhances client relationships by reducing audit-related stress and ensuring robust support during audits.

The benefits extend beyond immediate logistical support; they include full-service help from dedicated tax support teams, oversight by authorized IRS Enrolled Agents, and careful preparation of responses to IRS queries. Together these services work to ensure a swift and favorable resolution to audits.

Understand IRS Audit Procedures

Familiarize yourself with IRS audit procedures to safeguard your rights and maintain a compliance-focused environment.

Apply Procedures Effectively

Proper application of audit procedures can significantly decrease the possibility of continued IRS audits.

Engage Professional Tax Audit Defense

For those with complex tax returns or facing severe implications such as penalties or potential criminal charges, securing an experienced tax audit defense is crucial.

Ensure Accurate Document Submission

Timely and accurate submission of all required financial records helps prevent additional scrutiny and potential audit triggers.

Comprehend the Audit Process

A thorough understanding of the entire audit process and consistent provision of necessary documents can greatly reduce the likelihood of future IRS audits.

By partnering with these experienced professionals, taxpayers strengthen their defenses against potential audits, ensuring peace of mind and expert guidance through the complexities of the tax process.

Our tax relief attorneys specialize in tax problems and tax debt resolutions

Get started with a 100% free consultation

Facing an IRS audit, tax fraud charge, or business tax dispute? Protect your rights with a skilled tax litigation attorney. Call us today at (888) 342-9436

Are you facing IRS penalties? See how penalty abatement could help reduce your financial stress. Call (888) 342-9436 to talk with J. David Tax Law today!

Denied Non-collectible status? Learn the appeals process and secure your financial relief with J. David Tax Law. Call (888) 342-9436 for free consultation.